Abstract

Both media and academia have described the Seychelles’ blue finance transactions as a blueprint for marine conservation, national development and financial innovation. The two blue finance transactions are the 2016 Debt for Nature Swap facilitated by The Nature Conservancy, and the 2018 Seychelles Blue Bond facilitated by The World Bank. These initiatives are widely considered to fund activities that improve oceanic health and develop the nation’s “blue economy.” Specifically, these transactions fund a marine spatial planning process that culminates in establishing sizeable marine protected areas. Substantial and broad claims have been made in the media and in published academic research for the effectiveness of these financial innovations. We found that sovereign debt was not reduced by these transactions and has not diminished since. The ‘debt for nature swap’ did not secure environmental protections beyond commitments already made by the Seychelles Government prior to the swap with the exception of some minor changes in artisanal fisheries regulations, but did fund a planning process for their implementation. The significant no-take area for industrial fishing will simply lead to relocation of fishing effort. The characterizations of these blue finance transactions in media and in published academic research differ significantly from their reality. SIDS that are struggling with high public debt loads should be aware that these transactions will increase public indebtedness to fund activities and structures that reduce sovereign control of oceanic resources through shared governance.

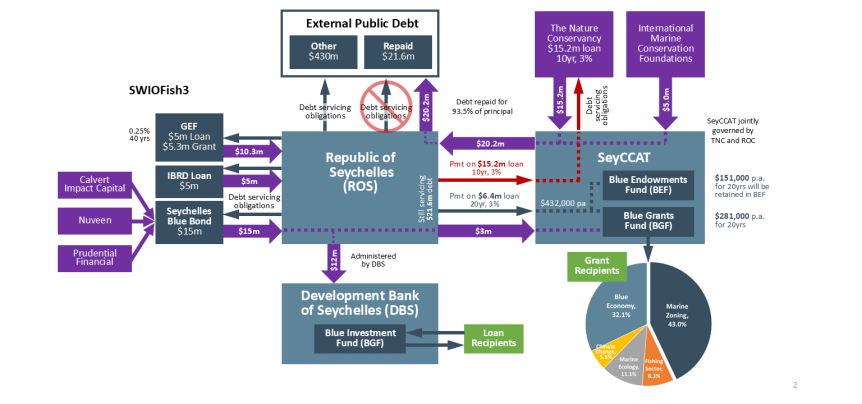

Graphical Abstract

Introduction

The Seychelles blue finance initiatives – the ‘debt for nature’ swap and the Seychelles blue bond – have been widely upheld as blueprints for other small island developing states (SIDS), both by the organizations that facilitated the transactions [1], [2] and by other observers [3], [4]. As Christiansen [5] notes, being part of the “blue finance discourse” has put Seychelles “on the world map politically.” Similarly, Schutter et al. [6] note that “Dominance of the blue economy on the international stage … brings Seychelles visibility and influence.” This worldwide interest in Seychelles as a ‘blueprint’ is not surprising, given Seychelles’ similarity with Polynesian, Micronesian and Caribbean small island nations with relatively large exclusive economic zones (EEZs) and long coastlines. With the Seychelles’ EEZ covering 1.34 m km2 of ocean relative to its 455 km2 land size, initiatives that enhance oceanic management and wellbeing are inherently attractive and applicable to other SIDS.

However, similarities between the Seychelles and other SIDS are necessary but not sufficient for the Seychelles blue finance initiatives to become a blueprint for wider adoption. The initiatives must also effectively achieve the outcomes that have been widely claimed for these transactions. This study identifies and evaluates these claims. First, though, we briefly describe the Seychelles blue finance initiatives.

Section snippets

The Seychelles blue finance initiatives

In the last decade, the Seychelles has participated in two debt financing initiatives that fund arrangements that are to protect and enhance its marine environment. These transactions, described below, are illustrative of blue finance, which is the oceanic version of what is more broadly referred to as environmental finance, climate finance or sustainable finance.

The Nature Conservancy’s ‘Debt for Nature’ transaction. On March 4, 2016, a US$21.6 m portion of Seychelles Government debt owed to

Claims for the Seychelles blue finance initiatives

The first two claims regarding the Seychelles blue finance initiatives are reflected in the name – debt for nature swap. That is, the initiative

- a.Reduces a nation’s public debt, and

- b.In exchange, secures protections for the nation’s natural resources.

These claims are illustrated in The Economist’s World Ocean Initiative commentary on the debt for nature swap [13], which mirrors The Nature Conservancy’s own press releases.

A pioneering debt-restructuring deal has enabled almost a third of the

Conclusion

The two Seychelles blue finance transactions have generated considerable media and academic research attention as a blueprint for other small island developing states. This is not surprising, given the claims made regarding these transactions.

Our assessment of these claims indicates that much of this attention and excitement is unfounded or is at least premature. The debt for nature swap has not reduced Seychelles indebtedness. Also, as a package, the two blue finance transactions have

Credit authorship contribution statement

Hilborn Ray: Writing – review & editing, Writing – original draft, Formal analysis, Conceptualization. Hunt Alister: Writing – review & editing, Writing – original draft, Funding acquisition, Formal analysis, Conceptualization.

Declaration of Competing Interest

None.

Acknowledgments

Dr Alister L Hunt thanks Opes Oceani for funding a portion of this research. Dr Hunt also received remuneration from the Pacific Islands Forum Fisheries Agency as an independent reviewer of its blue bond deliverable within the Pacific Islands Regional Oceanscape Program, Component 3: Sustainable Financing of the Conservation of Critical Fishery Habitats, funded by the World Bank International Development Agency and the Global Environment Facility. Tom McClurg provided valuable marine resource

References (62)

- M.S. Schutter et al. The blue economy as a boundary object for hegemony across scalesMar. Policy(2021)

- N. Shiiba et al. How blue financing can sustain ocean conservation and development: a proposed conceptual framework for blue financing mechanismMar. Policy(2022)

- D. Benzaken et al. From concept to practice: financing sustainable blue economy in lessons learnt from the Seychelles experienceMar. Policy(2024)

- D. Essers et al. Debt-for-climate swaps: killing two birds with one stone?Glob. Environ. Change(2021)

- A.O. Kılıç Seychelles blue bond: indebting ecological restructuring of fisheriesMar. Policy(2024)

- Republic of Seychelles, Process framework for SWIOFish3 Project. 〈http://www.finance.gov.sc/uploads/files/PF.pdf〉….

- The Nature Conservancy, Annual report, p. 11, Increasing ocean protection by 15% in 10 Years….

- I. Gerretsen, The deal that saved Seychelles’ troubled waters….

- A. March et al. Evaluating the world’s first sovereign blue bond: lessons for operationalising blue financeCommodities(2024)

- J. Christiansen State capacity and the ‘value’of sustainable finance: understanding the state-mediated rent and value production through the Seychelles Blue BondsEnviron. Plan. A: Econ. Space(2024)